Why fixed fee financial advice is so valuable to clients

Introduction: financial advice does matter

This article provides a complete guide to fixed fee financial advice, though before we dive into that, let’s look at the big picture of financial advice first. Good advice can transform a person’s financial future. It can be the difference between drifting along and achieving real financial security: building wealth steadily, funding education for children or grandchildren, buying a dream home or retiring without worry.

The numbers back this up, but there’s a catch

Research by the International Longevity Centre in London has shown that people who take financial advice can be tens of thousands of pounds better off after just a decade. Financial advisers add value – that is not in doubt.

However, the cost of that advice can have a huge impact on clients’ financial outcomes. Traditional fee models are complex, often misunderstood and in many cases cost clients far more than they realise. That’s where fixed fee financial advice has begun to change the industry.

What this guide about fixed fee financial advice will give you

At Smith and Wardle, we have offered fixed fees from when we were founded in 2020. We believe this model is the fairest, clearest and most beneficial way to pay for financial advice, and we applaud other advisers in the UK who follow this approach.

In this guide, we’ll show you the benefits of fixed fee financial advice and how to optimise your financial advice costs, whichever model is right for you.

The problems traditional percentage based fees create

Most financial advisers in the UK still charge clients a percentage of their assets each year. On paper, that looks straightforward: if your portfolio is £500,000 and the adviser charges 1%, you pay £5,000 per year. But this creates a range of real problems for clients and their finances.

Below are the three main problems this approach creates:

Lack of transparency, conflicts of interest

1% may sound easy to understand for some, but often clients never see this amount and don’t realise how much they are being charged. That’s because the investment platform typically subtracts the fees from the client’s investment pot in the background. Advisers must provide a clear statement of their overall fees, though clients often may not read or understand it. Not exactly transparent, is it?

Conflicts of interest

In addition, percentage based charging can create hidden conflicts of interest. Because the advisers’ income depends on keeping as much of a client’s money invested with them as possible, they may be less likely to suggest options like paying off a mortgage, giving money to family or using savings products outside their control, even if those are sensible choices.

They also have an incentive to recommend investments that stay within their fee based system, such as managed funds or portfolios, rather than simpler or cheaper products that don’t generate fees. And when it comes to risk, advisers may encourage clients to keep more money invested in higher risk assets than is wise – especially as retirement nears – because shifting into safer products would reduce the adviser’s earnings.

Lower investment returns

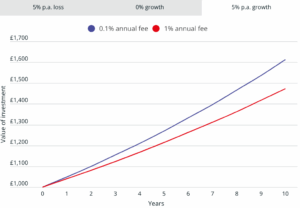

Investors should always seek to minimise the fees they pay, all else being equal. Any fees including advice costs reduce investment returns over time. This article from Which? explains the impact on client assets from a 1% annual fee and a fee of a tenth of that (0.1%). The below graph shows the difference in value over ten years across those fee levels of a £1,000 investment, growing at a typical rate of 5% annually:

After ten years, the fund with the 0.1% charge is worth £1,613, versus £1,473 with a 1% charge. The lower cost arrangement is worth over 9% more over that time period! And with larger asset values and longer periods of time, the gap in value due to the drag of higher fees only becomes greater.

Other costs to be aware of

The Which? article also goes on to discuss the impact of trading costs, investment platform fees, taxes and other costs. These lower investment returns in the same way. With this multitude of charges, keeping advice costs low is crucial.

Growth in fees over time, as assets grow

A real sting comes when you calculate the numbers over time. Take a client with £500,000 invested. At one per cent per year, the annual bill is £5,000. If the portfolio grows to £1 million, the fee doubles to £10,000. Over a twenty year period, the cumulative cost can easily exceed £150,000 – money that could have remained in the portfolio, compounding and working for the client’s financial future.

What happens over time

As your investments grow, so does your adviser’s cut, even if the amount of work involved doesn’t change. Many clients never realise that they have paid far more than they expected. While this does give advisers an incentive to drive investment returns to the mutual benefit of the client and the adviser, how can such growth in fees be in the best interest of the client? And do any advisers ever reduce their fees rate as assets grow? The percentage based charging model creates significant problems that the advice industry has not solved.

Real client story: from frustration to clarity

Our client Matt posted this review on VouchedFor:

“Christian has taken time to review and understand all my complicated finances, design a plan which works for me ongoing and for a fixed and reasonable cost. He has also been proactive in making helpful suggestions and inputting his own ideas and thoughts, and been approachable and easy to deal with. I am very happy with his service and expertise.”

Christian Lloyd-Williams

Matt is a new Smith and Wardle client, who switched from a different adviser

He had a great relationship with his previous adviser and was very thankful that they simplified his asset holdings. However, once they were simplified, he couldn’t understand why he was being charged so much, just because he had more money than someone else and the work for the adviser was no different.

So when he approached Smith and Wardle, he was “looking for a fixed fee advisor who could provide what I wanted, in order to reduce costs without sacrificing quality of service.” He found Christian Lloyd-Williams, pictured at left, and drove down from the Midlands to Hitchin (flat tyre notwithstanding!) to meet face to face to create a new financial plan and switch to the new service. Matt had a large portfolio with a wide range of investment products, and was paying c.£20,000 per year in fees to his old adviser, and growing every year.

Switching to fixed fee financial advice from Smith and Wardle changed everything

A fixed fee of £3,600 per year for ongoing advice immediately cut his annual costs by more than three quarters (75%). For the first time, Matt knew exactly what he would be paying, and no longer felt his adviser was quietly taking a larger slice of the pie with every passing year.

When asked whether he saw the outcome he was hoping for, Matt answered “yes, 100%”. Smith and Wardle’s fixed fee model has saved him thousands of pounds on his advice fees and helped him grow his wealth over time.

How fixed fee financial advice solves these problems

Fixed fee financial advice is exactly what it sounds like: set fees, clearly defined and communicated, regardless of how much money you have invested. While the client may have different service levels to choose from, whether your portfolio is £200,000 or £2 million, the advice costs the same, even as your assets grow.

Here is how fixed fees solve the problems:

Transparency

Fixed fee clients know in advance the fees they will pay. The fixed fee model should include a single up front cost to create a financial plan and implement it, along with an annual set fee to provide ongoing advice – which is not based on a percentage of invested assets.

(Many advisers tout a fixed introductory fee, and then follow that with ongoing percentage fees. This isn’t fixed at all. See below for more information on how to determine what an adviser is actually charging, you in detail.)

Clarity on fees and charges

The client should receive regular, clear statements of fees, which can be paid directly to the adviser (avoiding any reduction in investment returns) or subtracted from the investment pot, as the client prefers. All of this provides complete transparency on fees.

“What I find is that when clients know the cost up front, it changes everything. Instead of wondering what they’re really paying, they can focus on the advice itself – and that builds real confidence in the process and leads to the best outcomes for them.”

Katharine Ross, Smith and Wardle independent financial planner

At Smith and Wardle we’ve found that this approach brings a lot of trust into the relationship, because there is no conflict of interest. Our advisers focus squarely on helping you achieve your goals, not on inflating our income.

Truly independent advice

With a fixed fee model, the adviser’s payment doesn’t depend on how much money a client invests or where it is kept, so there are no hidden incentives shaping the advice. This means the adviser can focus fully on what is best for the client – whether that’s paying down debt, putting money into tax advantaged accounts, buying property or even giving financial gifts to family. Because the fee is clear and agreed upfront, clients know exactly what they are paying for. They can also trust that the guidance they receive is independent, transparent and aimed at helping them achieve their goals, rather than boosting the adviser’s income.

That is financial advice that is truly in the client’s best interest, which is what every adviser should do. Because it is the right thing to do, and also because of the regulatory standards that the Financial Conduct Authority sets. The FCA’s Consumer Duty regulation in fact requires just that.

Independence

Smith and Wardle clients benefit from this approach, reflecting independence as one of our core values. Our overall average client fees are about 0.3%, compared to upwards of 1% charged by many advisers and about 0.8% on average across the industry.1 We regularly recommend actions that reduce the assets held on our investment platform, because it’s the right thing for our clients and doesn’t affect our fee income. See below to learn more about how we do this.

1Sources: FCA, pension and investments ongoing charges, 2020, p.97; Professional Adviser, Average ongoing advice fees rise by 9bps, 2025

The softer benefits of fixed fee financial advice

While the greatest tangible benefit of fixed fee financial advice is cost savings, the advantages go well beyond money.

Fixed fees bring clarity. Clients know what they will pay and can budget accordingly. There are no hidden extras, no sudden jumps and no creeping percentage calculations to wrestle with. This transparency breeds trust, because the adviser’s compensation no longer depends on asset size. The relationship shifts from one that can feel transactional to one that is genuinely collaborative.

What this means over time

Over the long term, this predictability and fairness can transform the way clients view their finances. Instead of feeling wary or suspicious of costs, they feel in control. And that confidence often leads to better decision making and greater peace of mind.

Investment returns and fee inflation

Taking financial advice can lead to significantly higher investment returns, and clients should optimise fees within that. Everyone should compare fee quotes across at least a few advisory firms, and see how they work out in cash terms relative to the amount of money you plan to invest.

Often, fixed fees work out cheaper for larger asset pots, and can easily do even for moderate pots. Very small pots may actually work better on a percentage fee basis, though this can flip with asset growth over time, and so every client should check this carefully.

Looking into the future

Be very careful to estimate fees over time, with the knowledge that percentage based fees will grow as your assets grow. This can make a huge difference over time, as explained above.

For clients like Matt, mentioned in the earlier client story, fixed fee financial advice meant real savings, with a service provided as he described it at “a fixed and reasonable cost”.

Why Smith and Wardle lead the way in fixed fee financial advice

Smith and Wardle was founded on a simple principle: financial advice should serve the client first

We believed from the start that percentage based charging undermines that principle, and so we pioneered a fixed fee approach in the UK. Today, we remain the country’s leading fixed fee IFA, with hundreds of clients who value the clarity and fairness of our model.

This philosophy runs through everything we do. We refuse to hide behind complicated charging structures. We don’t allow fees to inflate automatically as portfolios grow. And we never accept conflicts of interest in our advice. For us, fixed fees are not just a pricing structure – they are a core part of our values.

Our mission: share the benefits of the fixed fee financial advice model

We set out to prove that financial advice can be fair, transparent and truly client-focused. Fixed fees aren’t just about cost – they’re about removing doubt and putting trust back at the centre of the relationship.

We strongly believe that the work and complexity involved in creating a financial plan should be what drives the cost. The complexity of the work in each stage of a financial advice journey may vary. Some clients have complex needs when it comes to setting up your financial plan and implementing any recommended actions, and then have fairly simple ongoing requirements once everything is in place.

We provide clients with a clear explanation of our fees at every stage of the process, before proceeding with any chargeable work, which ensures there are no hidden surprises.

“I point clients to the fees explanation on the website before our first meeting, and that way they come to the meeting with a clear understanding of how our fees work. I find it really helps with clarity of expectations, so we can focus the discussion on what their goals are and how we can help achieve them.”

Simon Jackson, Smith and Wardle independent financial planner

How to spot if an adviser’s fees are really fixed

Not every adviser who advertises “fixed fees” truly offers them. Some use the term loosely, with hidden caveats. Clients should always check whether the fee is genuinely independent of portfolio size, or whether it rises once assets pass a certain threshold. Others may fix the fee in year one, but then revert to percentage charging afterwards. A variation known as “capped percentage fees” is sometimes marketed as fixed, but these are still tied to asset size.

The best way to be certain is to ask clear, direct questions:

- Does the fee stay the same if my investments double?

- Will I ever pay more simply because my wealth has grown?

- Do you levy any charges based on a percentage of the assets that you manage for me?

Financial advisers are required by FCA regulation to provide clear communication of all charges, so this conversation should be an open one. If the adviser seems less than willing to share the full information, do point this out to them!

At Smith and Wardle, we encourage prospective clients to ask questions about our fees, because we know our answers will always be reassuringly simple.

Working out what your fixed fees would be at Smith and Wardle

Many clients only realise the impact of fees when they see the numbers side by side. That’s why we provide a straightforward fee page, allowing you to understand what your fixed fees at Smith and Wardle are likely to be.

Smith and Wardle offer holistic financial planning advice. We start by understanding clients’ current situation, life goals and investment objectives, to create a comprehensive financial plan. We can then help clients implement the changes recommended in the plan, including switching investments to more suitable funds,etc. In many cases, we also provide ongoing advice to those clients, though some choose to execute the plan themselves.

How to work out what this would mean for you

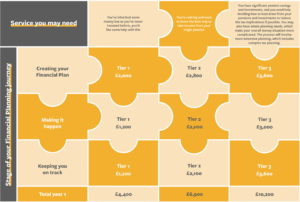

For each stage of the financial planning journey we offer three different levels of service, which align with the range of complexity of our clients’ needs. You can work out which level fits you best with our fee page.

Once you have done that, you can easily work out where you sit on the below puzzle matrix and total up how much you would pay for Smith and Wardle’s financial planning service.

The big picture: your fees at Smith and Wardle

We encourage you to try our fee page to see what the cost of advice would be as a Smith and Wardle client, and contact us if you have any questions.

Comparing fixed fees with traditional adviser charging

The good news is that once you have worked out how much a traditional adviser will charge, it’s really easy to compare with Smith and Wardle’s fixed fees.

We’ve created this simple table, which compares the two based on a client’s asset base and complexity of needs:

| Portfolio value and complexity level | 1% ongoing annual fee | Smith and Wardle ongoing advice fixed fee |

| £100,000, low complexity |

£1,000 |

£1,200 for all low complexity clients |

| £250,000, moderate complexity |

£2,500 |

£2,100 for moderate complexity clients |

| £500,000, low complexity |

£5,000 |

£1,200 for all low complexity clients |

| £750,000, high complexity |

£7,500 |

£3,600 for high complexity clients |

| £1,000,000, high complexity |

£10,000 |

£3,600 for high complexity clients |

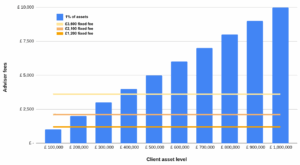

As the table shows, while smaller portfolios would pay slightly more with a fixed fee, the long term savings for clients with £250,000 or more invested are significant – not to mention the value of having the clarity of a fixed fee.

Our fee levels compared with an adviser charging 1%

Use our fee page to see what this would mean for you exactly.

This shows that for clients with simple needs, across almost all the asset levels Smith and Wardle’s fixed fees cost less than a 1% adviser charge. For more complex needs, those with larger asset values would also clearly benefit from fixed fees.

Only for those with asset levels in the £100,000 range would benefit from percentage based fees at the 1% level, but of course as their assets grow over time, this may no longer be the case.

Frequently asked questions about fixed fee financial advice

Fixed fee advice means you pay a clear, set amount for your financial planning and ongoing support, no matter how much money you have invested. Instead of a percentage that grows as your portfolio grows, the cost is agreed upfront and stays the same. This makes fees simple to understand, easy to budget for and completely transparent. With Smith and Wardle, we have fixed fees for everything from creating your financial plan to providing ongoing advice, so you always know where you stand.

Not always. For smaller portfolios, a percentage-based fee may initially look lower. But as your investments grow, the costs of percentage charging rise sharply – often reaching thousands of pounds more each year than a fixed fee. That’s why fixed fees are particularly powerful for clients with portfolios over £100,000. Even when the cost is similar, many clients prefer the fairness and peace of mind of knowing their adviser’s fee won’t automatically increase just because their wealth has grown.

The reality is that percentage based charging is more profitable for many advisers. When fees rise automatically as client portfolios grow, advisers’ incomes increase without extra work. This makes percentage models attractive to firms, but less so for clients. At Smith and Wardle, we believe financial advice should always put the client first – which is why we chose a fixed fee model from the start. It’s fairer, more transparent and removes conflicts of interest, so our focus stays where it belongs: on helping clients achieve their goals.

A truly independent adviser is not tied to any one provider or restricted to a set list of products. They can recommend the whole of the market and will always put your interests first. One simple test is to ask whether their fees change depending on how much money you invest or where you invest it. If they earn more by keeping your money in certain products, there may be a conflict of interest. At Smith and Wardle, our fixed fee approach means our advice is not influenced by commission or percentage charges – we’re paid the same regardless of your portfolio, so our guidance stays 100% focused on what’s right for you.

Fixed fee advice can work for almost anyone, but it offers the greatest benefits to clients with portfolios of £100,000 or more, where percentage based fees quickly add up. These clients can save thousands of pounds each year while gaining peace of mind that costs won’t rise as their wealth grows. That said, even clients with more modest portfolios often choose fixed fees for the transparency and fairness they provide. The real value lies in knowing exactly what you’ll pay, regardless of how markets move or your portfolio changes.

Yes, absolutely. Our fee page is designed to give you a clear outline of Smith and Wardle’s fixed fees. You can use it straight away on our website, before you ever speak to us. It shows you, in pounds and pence, how much you are likely to pay, though of course we need to discuss your specific personal details with you to confirm the levels. We believe this kind of transparency is essential – it helps you make an informed decision, without any surprises later on.

Real world example: fixed fee financial advice in the USA from Facet Wealth

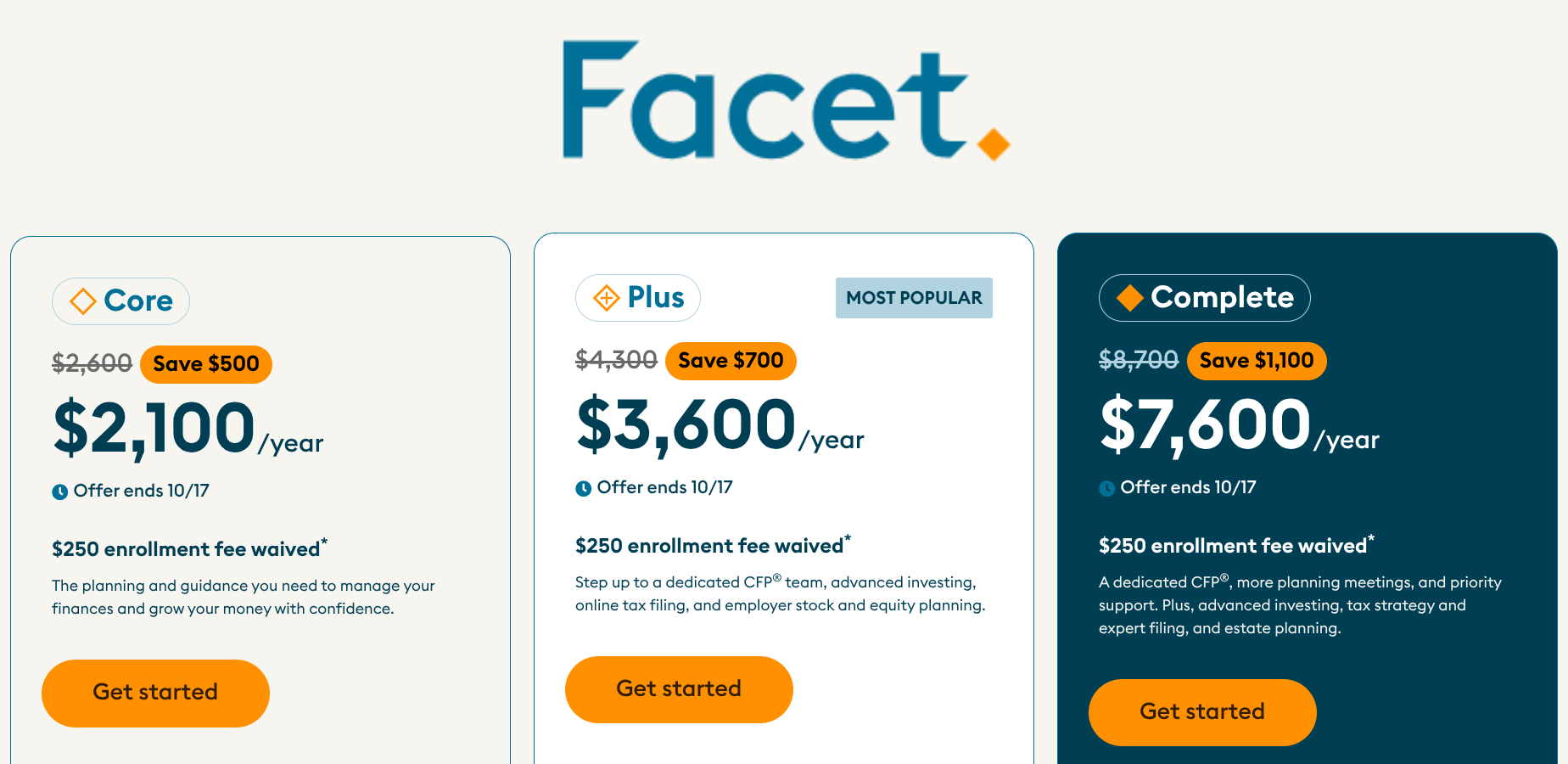

The United States has a very well developed investment culture, with a large proportion of the population holding investments. Facet is a financial advice firm founded in 2016, and has grown to $40m in revenue in 2024. Facet use a transparent, fixed fee structure for all of their clients, with their plans ranging from $2,100 to $7,600 per year.

We applaud Facet’s approach, and in fact they inspired parts of our business model. The success they have achieved in the competitive American financial advice space is testament to the benefits fixed fees have for clients. We at Smith and Wardle are proud to bring a similar approach to our clients in the UK.

Conclusion: fixed fee financial advice, done the right way

Fixed fee financial advice removes complexity, reduces conflicts of interest and saves clients money over the long run. It offers clarity, fairness and above all, trust. That is why Smith and Wardle made fixed fees central to our philosophy from day one, and we continue to lead the UK market in this area.

If you are ready to see how much you could save, use our fee page today. And if you want to experience the peace of mind that comes with transparent, fair advice, book a free consultation with one of our advisers.

At Smith and Wardle, our promise is simple: transparent, fair, fixed. That’s financial advice, the way it should be.

Smith & Wardle Financial Planning is a trading name of Smith & Wardle Financial Consultants LLP (OC398850). Registered in England and Wales, our registered office address is Suite B, Gloverside, 23-25 Bury Mead Road, Hitchin SG5 1RT.

We are authorised and regulated by the Financial Conduct Authority (FCA) under registration number 912090.

The content of this website is meant for information purposes only, and does not constitute advice. The value of investments can fall as well as rise, utilising investment products places capital at risk.

Click here to read our complaints policy.

Suite B, Gloverside

23-25 Bury Mead Road

Hitchin

Herts

SG5 1RT

Production

Production