Over the last 18 months, interest rates have increased and the rate your savings could earn has slowly been rising. However, with some experts predicting they will begin to fall towards the end of the year, should you lock in an interest rate now?

Double-digit inflation figures have led to the Bank of England increasing interest rates

The Bank of England (BoE) has gradually increased its base interest rate since the end of 2021. In November 2021, the base rate was just 0.1%. This meant the cost of borrowing was low, but savers suffered.

After a series of increases, the base rate stood at 4.5% as of May 2023. For savers, this is good news as it provides an opportunity for their savings to work harder.

The steps taken by the BoE are in response to high levels of inflation. The after-effects of the Covid-19 pandemic and the ongoing war in Ukraine mean the cost of goods and services have increased well above the BoE’s 2% inflation target. In fact, for much of 2022 and the start of 2023, the figure has been in double digits.

As a way to try and slow the pace of inflation, the BoE started to increase its base rate. Other central banks around the world, including the EU and US, have taken similar steps.

While the inflation rate has remained stubbornly high at the start of 2023, the BoE expects it to “fall quickly” overall this year. It stated there are a few reasons for this, including:

- Wholesale energy prices have fallen a lot

- An expected sharp fall in the price of imported goods

- The cost of living crisis means households will spend less.

So, as inflation stabilises and starts to fall, what does that mean for interest rates and your savings?

The UN financial agency predicts interest rates will return to pre-pandemic levels

The International Monetary Fund (IMF), a financial agency of the UN, expects interest rates to start to fall once inflation is tackled.

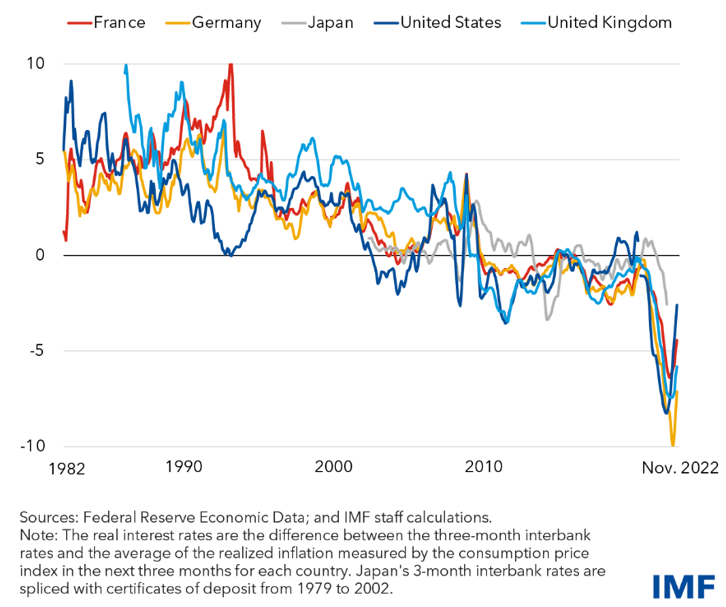

According to the organisation, since the mid-1980s, real interest rates across advanced economies have been steadily declining. The graph below shows that while interest rates did sharply decline during the pandemic, it was part of a wider trend. Instead, the current rising rate we are experiencing could be a blip.

Source: International Monetary Fund

So, while you may think of low interest rates as unusual, especially when you consider the higher rates you may have experienced in the 1970s and 1980s, they could be the “new normal”.

In fact, the IMF projects the UK’s natural interest rate will remain below 0.5% over the coming decades.

Even economies that are emerging and rapidly developing with a higher natural interest rate are expected to follow the same trend. The IMF projects China and India will experience a steady decline in interest rates and will fall below 1% during the 2030s.

You may be able to lock in an interest rate, but it isn’t always the right decision

With the IMF’s predictions in mind, it could make sense to lock in the interest rate on your savings now.

Choosing an account that guarantees an interest rate for a defined period could be attractive. However, these types of accounts may require you to deposit a certain amount each month or mean you can’t access your savings during this period. So, it’s important to understand the terms first.

You should also keep in mind that the predictions aren’t a guarantee. A huge range of factors affect interest rates, so they could also remain where they are or even rise further. In these circumstances, locking in an interest rate could mean you miss out.

What’s most important when deciding whether to lock in an interest rate, or, indeed, when you’re making other financial decisions, is your goals.

Set out what you want to achieve with your savings first.

Your goals play a pivotal role in deciding where to place your savings. You may even find that saving isn’t the right option for you – perhaps investing would be suitable if you’re saving with a 10-year goal in mind. Alternatively, reducing debt could be a more effective way to improve your long-term finances.

Call us to talk about your saving goals

There’s no one-size-fits-all solution when considering how to get the most out of money. Contact us to talk about your goals and concerns. We will talk through your different options and help you understand what could be right for you.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Production

Production