During the Autumn Budget, chancellor Rachel Reeves unveiled an increase to Stamp Duty that could affect buyers of second homes and property investors. The temporary higher thresholds for Stamp Duty are also set to end in 2025 and could lead to larger tax bills when buying property.

Read on to find out what you need to know about the tax.

Stamp Duty is a type of tax you pay when buying property or land

In England and Northern Ireland, Stamp Duty is a type of tax you may pay when buying property or land. The rate you pay varies depending on the value of the property or land, and whether it’ll be your main home.

Please note, Scotland and Wales have similar taxes to Stamp Duty known as “Land and Buildings Transaction Tax” and “Land Transaction Tax” respectively. The thresholds and reliefs for these taxes are different to Stamp Duty.

The Stamp Duty surcharge for second properties has increased by 2%

During the Budget, Reeves announced that changes to the rates of Stamp Duty when buying additional properties would rise from 31 October 2024.

The “Higher Rate for Additional Dwellings” previously meant that people buying a second property or investors paid a 3% Stamp Duty surcharge. This surcharge has now increased to 5%. As a result, those looking to expand their property portfolio could face a larger bill than expected.

In the Budget speech, Reeves said this change would “support over 130,000 additional transactions from people buying their first home, or moving home over the next five years”.

The Stamp Duty thresholds will fall on 1 April 2025

As well as the higher rates for second properties, the thresholds for paying Stamp Duty are set to rise and could affect home movers and first-time buyers.

Former prime minister Liz Truss temporarily slashed Stamp Duty thresholds in 2022 as part of the “mini-Budget”. This temporary measure will end on 1 April 2025.

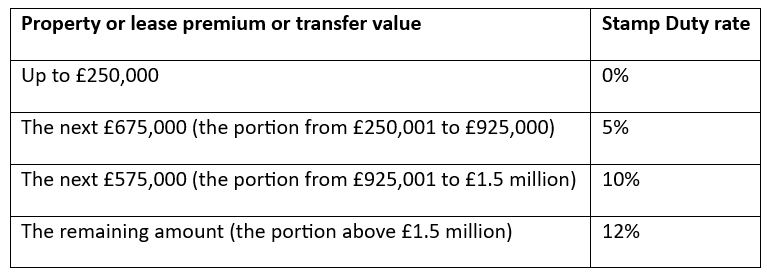

This means that if you purchase property before the 31 March deadline, the thresholds and rates of Stamp Duty will be:

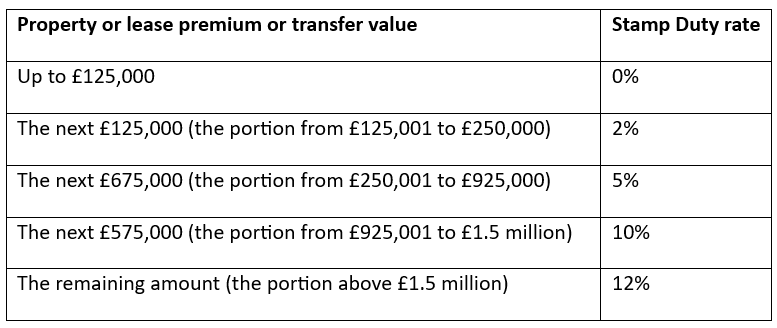

However, if the property transaction went through on or after 1 April 2025, the rates and thresholds will be:

Let’s say you’re buying a property worth £600,000 and it will be your only home. Under the current rules, you’d be liable for Stamp Duty of £17,500. If you delayed buying until after the change comes into force on 1 April 2025, you’d pay an extra £2,500 in Stamp Duty.

The first-time buyer’s relief will also change.

Up to 31 March 2025, first-time buyers can benefit from a discount if the property they are buying is worth less than £625,000. Eligible first-time buyers don’t need to pay Stamp Duty on the first £425,000 and would pay a lower rate of 5% on the portion of the property valued between £425,001 and £625,000.

From 1 April 2025, the threshold for paying Stamp Duty as a first-time buyer will fall to £300,000, and they will pay Stamp Duty at a rate of 5% on the portion between £300,001 and £500,000. If the price of the property exceeds £500,000, the relief cannot be used.

Stamp Duty changes could lead to a jump in property transactions

In a bid to avoid potentially higher Stamp Duty, it’s expected that those currently purchasing property will try to push transactions through before 1 April 2025. Some people who have been contemplating buying property in the new year might also be tempted to start the process sooner to complete the transaction before the changes come in.

Indeed, speaking to the BBC, Robert Gardner, chief economist at Nationwide, predicts a boost in activity followed by a six month slump. He noted that the effect of the changes is not likely to be as large as previous ones as high interest rates are still putting off some buyers.

Still, the changes could lead to a sizeable jump in property transactions during the first quarter of 2025.

Contact us to talk about your mortgage needs

As a mortgage adviser, we could offer you support when you’re searching for a mortgage deal if you plan to purchase property or land in 2025.

If you’re hoping to complete a property purchase before the Stamp Duty thresholds and reliefs change, ensuring the mortgage application process is as smooth as possible could be crucial. We’re here to offer you guidance and help you minimise delays.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

The Financial Conduct Authority does not regulate buy-to-let (pure) and commercial mortgages.

Production

Production